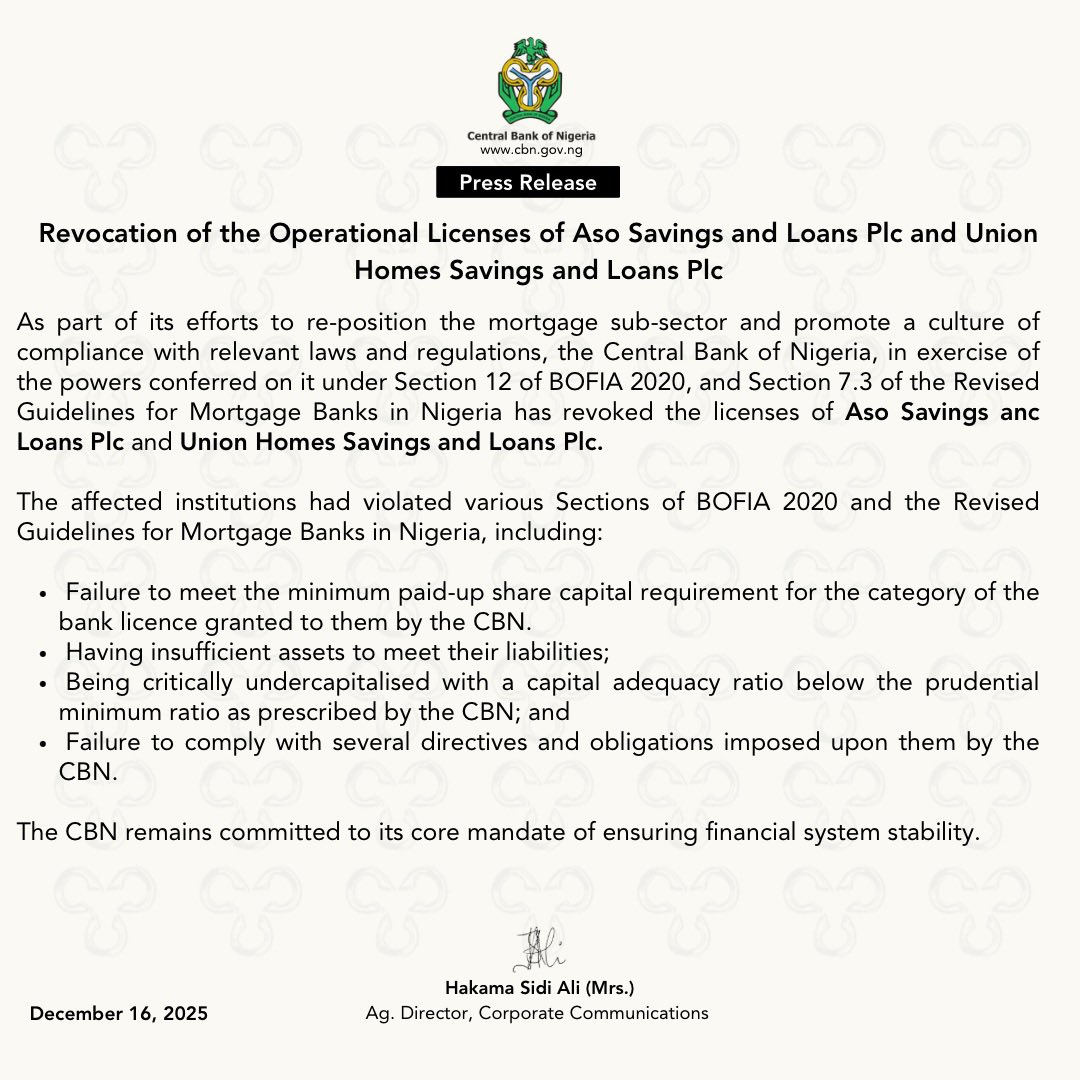

In a move aimed at strengthening the mortgage sub-sector and encouraging strict adherence to applicable laws and regulations, the Central Bank of Nigeria (CBN) has withdrawn the operating licences of Aso Savings and Loans Plc and Union Homes Savings and Loans Plc.

The decision, taken in line with the CBN’s powers under Section 12 of the BOFIA 2020 and Section 7.3 of the Revised Guidelines for Mortgage Banks in Nigeria, was announced in a statement issued on Tuesday and signed by the Acting Director of Corporate Communications, Mrs. Hakama Sidi Ali.

According to the statement, the affected mortgage banks were found to have breached several provisions of BOFIA 2020 and the revised guidelines. These violations include failure to meet the minimum paid-up share capital required for their licence category, inadequate assets to cover liabilities, severe undercapitalisation reflected in capital adequacy ratios below the CBN’s prescribed minimum, as well as persistent non-compliance with regulatory directives and obligations.

The statement reaffirmed the CBN’s resolve to uphold its primary responsibility of maintaining stability within Nigeria’s financial system.

Read also: Air Peace Expands Domestic Flights, Resumes Warri Operations Ahead of Holiday Rush