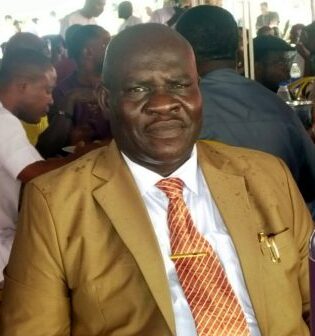

Executive Director, Board of the Delta State Internal Revenue, Collins Iwebunor says expansion of tax net would be technology driven.

The new Board of the Delta State Internal Revenue Service was inaugurated on Friday, 21st July, 2023, by Governor Sheriff Oborevwori, with a charge to expand the state’s tax net to capture more businesses in the informal sector.

Speaking in an interview with journalists at the venue of the reception put together for guests by members of the Board, the Executive Director, ICT and Corporate Development, Mr Collins Iwebunor, said the task would be technology driven.

Mr Iwebunor stated that the Board’s existing tax collection patterns and processes would be carefully studied with a view to reviewing and upgrading them in line with modern technological templates and international best practices.

The Executive Director admitted that the burden of taxation was more on the formal sector, which comprised mainly of civil servants captured in the payroll system, while the informal sector had remained porous with a high rate of tax evasion.

He said the Governor’s charge was timely given the fluctuating price of crude oil in the global market, which had made oil revenue unreliable, hence the need for government to explore other sources of revenue to be able to fund its budgets and embark on the execution of projects.

Mr Iwebunor explained that aggressive awareness campaigns would be mounted to encourage operators in the informal sector of the state to pay tax to keep the engine of government running, pointing out that all perceived leakages in the system would be blocked using modern technologies to strengthen the revenue base of the state.

He said tax review ought to be a yearly affair and not periodic, stressing that the idea of collecting tax clearance certificate every three or four years was no longer realistic under the present day realities.

The Executive Director expressed confidence in the capacity to the Ighrakpata-led Board to generate revenue from all sources possible, particularly in the informal sector, within the ambit of the law