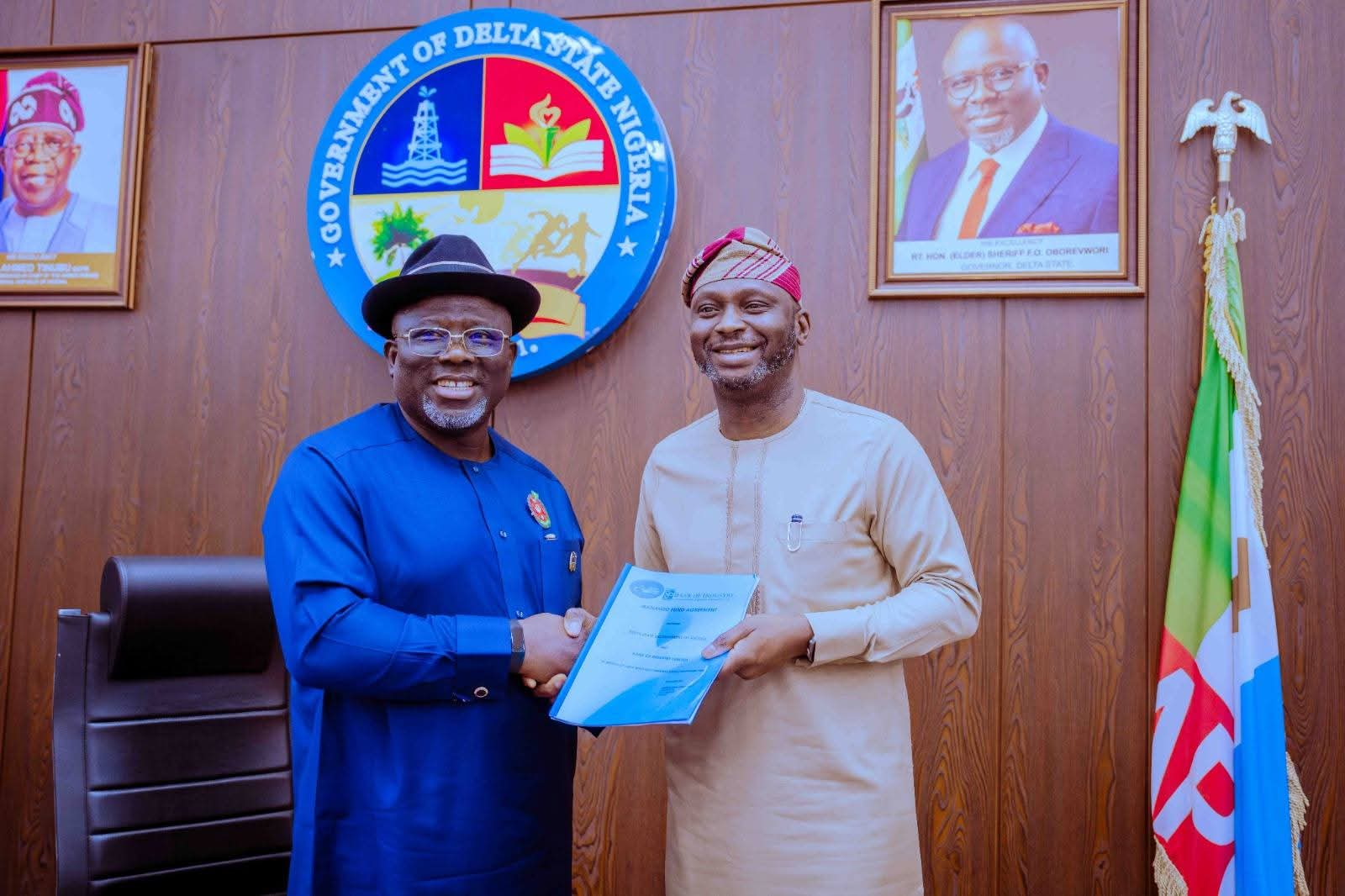

The Delta State Government on Tuesday signed a Memorandum of Understanding (MoU) with the Bank of Industry (BoI) for the management of a ₦1 billion revolving loan fund aimed at boosting Micro, Small and Medium Enterprises (MSMEs across the state.

The signing ceremony, which took place at Government House, Asaba, marked a significant step in the implementation of Governor Rt. Hon. Sheriff Oborevwori’s MORE Agenda, focused on inclusive growth, job creation and sustainable economic development.

Speaking at the event, Governor Oborevwori described the initiative as a major milestone in his administration’s economic empowerment drive, noting that the fund was approved by the State Executive Council in 2025 to address the long-standing challenge of limited access to affordable financing faced by MSMEs.

“Today marks a remarkable moment in our administration’s unwavering commitment to job creation, inclusive growth and sustainable economic development,” the Governor said.

He emphasized the critical role of MSMEs in economic growth, describing them as the backbone of any strong economy due to their capacity to generate employment and drive grassroots development.

“By providing our traders, artisans, agro-processors and small-scale manufacturers with access to capital at single-digit interest rates, we are equipping them with the resources they need to expand their businesses, create jobs and contribute meaningfully to our economy,” Oborevwori stated.

The Governor explained that the fund was deliberately structured as a revolving loan to ensure sustainability and continuous access for qualified entrepreneurs. He stressed that loan recovery was central to the success of the programme.

“This ₦1 billion is a revolving fund. Loans granted under this arrangement must be recovered so that other eligible entrepreneurs can also benefit. This responsibility is non-negotiable and must be discharged with the utmost diligence and integrity,” he said.

Oborevwori noted that the choice of the Bank of Industry as fund manager was based on its reputation as Nigeria’s foremost development finance institution, with strong credit appraisal systems and robust business support frameworks.

“Our partnership with the Bank of Industry goes beyond finance. It integrates vital business development and support services that entrepreneurs need to succeed and thrive in today’s highly competitive economy,” he added, expressing confidence in the bank’s capacity to manage the fund transparently and efficiently.

Reflecting on previous empowerment initiatives, the Governor acknowledged the importance of grants but cautioned against over-reliance on them, noting that structured loan schemes promote accountability and financial discipline.

“When you keep giving grants without structure, some beneficiaries may not value the funds. This loan-based model will instil financial discipline and help entrepreneurs appreciate the value of money, invest wisely and grow sustainably,” he explained.

He clarified that the revolving loan scheme would not replace existing empowerment programmes, assuring that grants and other support initiatives would continue where necessary.

“This MoU is another critical pillar of our broader economic empowerment strategy. It complements, rather than replaces, our ongoing interventions,” Oborevwori said.

On the timing of the initiative, the Governor disclosed that the programme was shifted from December to January to maximize its impact.

Also see: Akpobolokaemi Commends Monarch’s Visionary Scholarship Programme

“January is when entrepreneurs are fully focused on rebuilding and expanding their businesses for the year,” he noted. Looking ahead, Oborevwori revealed that the fund could be scaled up significantly if effectively managed.

“If this fund demonstrates impact, there will be no limit to what we can do together. We can scale it to ₦10 billion, ₦20 billion or even ₦30 billion. This is a starting point,” he declared.

Earlier, the Managing Director of the Bank of Industry, Dr. Olasupo Olusi, described the partnership as a strategic move to expand enterprise activities and unlock sustainable economic growth in Delta State.

He said the ₦1 billion revolving fund would strengthen MSMEs by improving access to affordable financing and deepening collaboration between the Delta State Government and Nigeria’s premier development finance institution.

According to Olusi, the initiative aligns with the BoI’s mandate of translating government policy priorities into practical financing solutions that address real business challenges across key sectors of the economy.

“As Nigeria’s leading development finance institution, the Bank of Industry remains committed to working closely with governments and the private sector to create opportunities for businesses to innovate, create value and remain competitive,” he said.

The BoI Managing Director also commended the Delta State Government for its commitment to economic development, describing the MoU as a clear demonstration of the Oborevwori administration’s resolve to empower entrepreneurs and build a resilient private sector capable of driving long-term prosperity in the state.