When Governor Sheriff Oborevwori assumed office in Delta State, one of the major challenges confronting his administration was the long-standing issue of unpaid local government pensions.

For various reasons, retired staff of the teaching service, the 25 local government councils, and the Local Government Education Authorities had accumulated pension arrears stretching back more than ten years. The outstanding liability was estimated at over ₦50 billion, leaving many retirees in severe hardship.

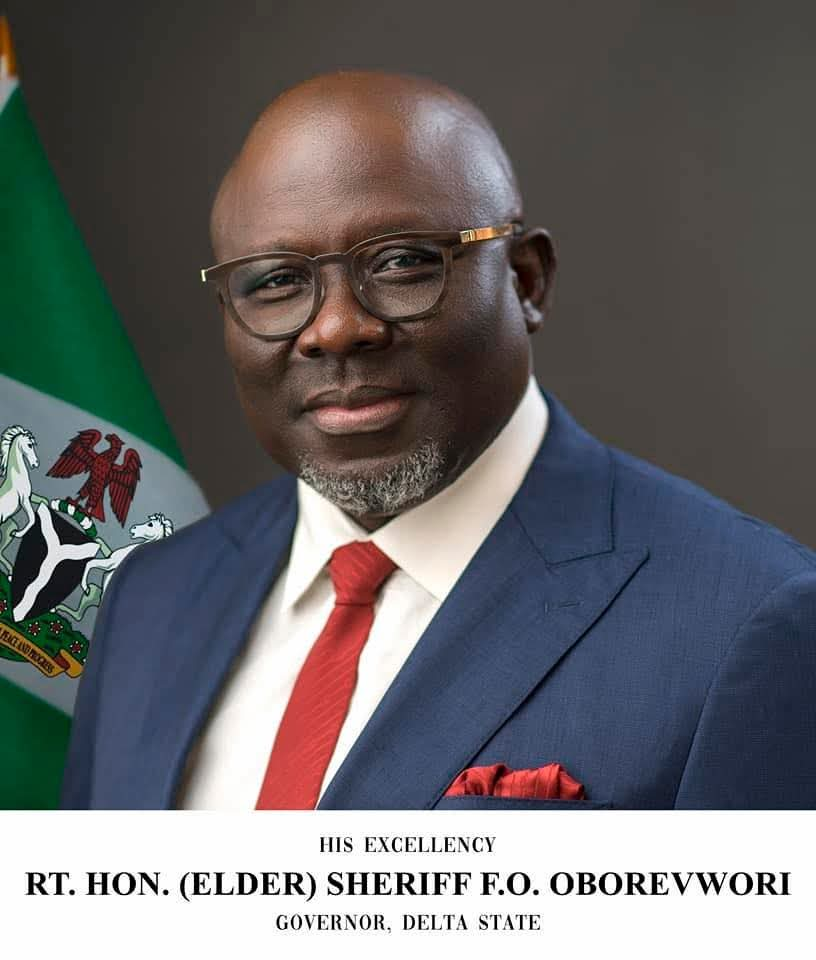

Although the responsibility for paying local government salaries and pensions rests with the councils rather than the state government, Governor Oborevwori recognised that the primary duty of government is to safeguard the welfare and economic security of its citizens. In his view, no justification could excuse the continued denial or delay of retirees’ benefits after years of service.

Guided by this conviction and consistent with the core objectives of his MORE Agenda, the governor resolved that the lingering pension crisis must be addressed decisively and permanently. He therefore engaged local government chairmen and the leadership of the Delta State Bureau of Local Government Pensions to chart a sustainable path forward.

The initial hurdle was clearing the accumulated accrued pension rights dating back to 2011. Following deliberations at the State Joint Account Committee (JAC), all 25 local councils agreed to jointly secure a ₦40 billion loan, with the state government providing the necessary guarantee. This was further supported by an additional ₦1.8 billion released by the JAC, significantly reducing the backlog.

As a result, jubilation spread across the state when more than 11,400 pensioners, covering arrears up to September 2024, received their payments. In December 2025, the JAC approved another ₦1.5 billion to settle the benefits of an additional 400 retirees, extending the clearance of arrears up to April 2025.

For many retired local government and Local Government Education Authority workers, the development brought immense relief.

However, according to the Chairman of the Delta State Bureau of Local Government Pensions, Mr Benjamin Igo, funding alone was not the only challenge. He explained that difficulties faced by some retirees stemmed from improper enrolment in the Contributory Pension Scheme, incomplete documentation, and discrepancies in records, among other issues.

To address these challenges, the Bureau—working with the support of the governor and local council chairmen—launched a sensitisation and enlightenment tour across the 25 local government areas. The initiative was designed to reach pensioners at the grassroots, address their complaints directly, and educate serving workers on correct enrolment procedures under the Contributory Pension Scheme.

Officials of the Bureau, alongside representatives of the National Pension Commission and various Pension Fund Administrators, participated in the outreach. Through these engagements, many retirees and active workers were able to resolve outstanding issues and gain a clearer understanding of pension processes, enabling smoother and timelier access to their entitlements.

Following the completion of the sensitisation programme, numerous complaints and challenges affecting both retirees and serving staff were successfully resolved. The Bureau also took an additional step by producing a comprehensive handbook on the Contributory Pension Scheme, which was distributed across all local councils and Local Government Education Authorities for easy reference.

For the Oborevwori administration, the leadership of the Bureau of Local Government Pensions, and the council chairmen, the resolve remains firm: to fully clear the pension backlog and ensure retirees receive what they are rightfully owed.